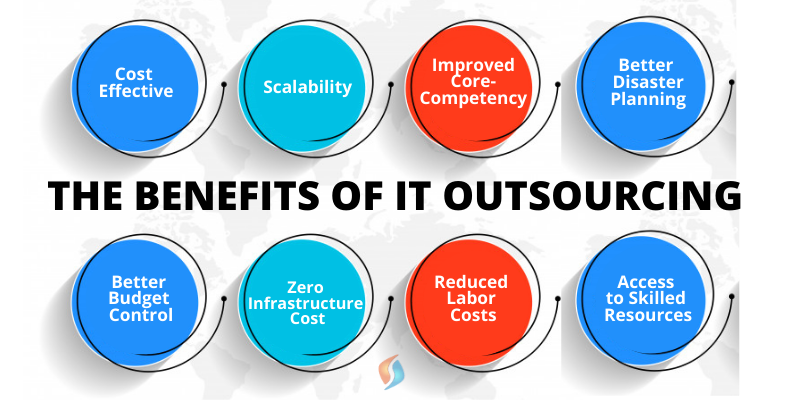

IT Outsourcing is becoming a necessity for the current business climate. Whether it is QA testing, Mobile application development, Web design, or software support, technology is changing at a rapid pace, requiring fresh ideas and scalable solutions. To keep up with the pace of change, IT workforces need to grow. According to the Worldwide Developer Population and Demographic Study, by 2025, software developers will increase by 75%. For your business to stay competitive, it needs to find new ways to stay ahead of the curve.

QA testing

When looking for QA outsourcing services, it is important to choose a company with the necessary expertise. References and a proven track record are important. In addition, the testing team should have expertise in the particular vertical in which you’re looking to outsource. A reliable vendor will offer test documentation and templates that will assist you in your process. Read on to find out more about the types of testing services available. Here are three key factors to consider when selecting Toronto IT outsourcing service:

Mobile application development

Outsourcing means handing over the mobile development tasks to experts outside your company. You can outsource this process to any reputed company that can take care of all the phases. While the initial round of interviews was primarily an introductory one, the later stages should be more comprehensive. To choose the best agency, analyze its past performance and track record. Moreover, select one that has proven track record. A reputed company will be able to meet the project deadline and budget.

Web design

Outsourcing web design services can be a great advantage for a business because they provide the benefit of a talented team of designers. Outsourcing web design services allows you to focus on your core competencies and can also help your staff flourish. Web design outsourcing services give you access to a talented team of designers that know how to maximize the benefits of your website. Third-party web development firms are also knowledgeable about the latest trends and technologies in web design.

Software support

If you are looking for an IT outsourcing company to help you with your software support needs, you can find plenty of options in the market. However, outsourcing software support is not without its risks. The right partner for the job might not live up to your expectations and requirements, and this could lead to unpleasant situations. Aside from that, hiring an inexperienced service provider can cost you a lot of time and money. If you are unsure of how to hire a software support outsourcing company, here are some steps to ensure success:

Disaster recovery plan

It is important for a business to have a disaster recovery plan in place, but how do you know whether you’re on track to have one in place in case of a disaster? There are several ways to go about developing a disaster recovery plan, but there is no single right answer. While some disaster recovery plans are one size fits all, the plan developed by NIC is custom-tailored to each client. Disaster recovery plans are calculated based on the IT budget and contingencies.

Canadian mailing address format comes in a number of different formats, each one unique. The most commonly used today is the standard Canada post mailing address format. This can be used for both individuals and companies. The other two most commonly used formats are the United States Postal Service (USPS) form and the Post Office of Canada (PC) form.

What is the Address Format in Canada?

In addition to being used as a means of indicating the sender’s name, the mailing address format canada can also be used to display the recipient’s name. For instance, in the US, when you write someone an email, it will use their first name, middle name, and last name as the subject line. The first name appears to be the sender’s name, while the last name appears to be the recipient’s name. This mailing address format is also used in letters that are sent, even though it does not seem as formal. For example, if your friend were to send you a letter, it would display their name and address on the envelope.

Canadian mailing address format can be used in business communications as well. If you are a businesses owner, you can have your company’s mailing address format professionally designed. This is especially helpful for the small businesses that are not yet properly established. By getting a professional to design your company’s address format, you can be assured that it will be viewed by potential clients and customers. Having a professionally designed mailing address format will give your company a more professional image, making you more appealing to potential clients and customers.

While having a professional to create your company’s mailing address format is beneficial, there are times when you do not want to hire someone to do it for you. In these situations, there are some alternatives that you can utilize. The best part about these solutions is that they are easy to use. As an example, if you use Microsoft Word, you can create your own customized mailing address format within minutes.

One of the best alternatives to the traditional mailing address format that you can get in Canada is the downloadable mailing address format. This is because it is designed for quick and easy creation. With this option, you can get your own unique mailing address format without having to worry about spending a lot of time or money. In fact, you can get this form of address format relatively inexpensively.

There are different reasons why people choose to go with the downloadable mailing address format. One of the most common reasons is the fact that you can change your information at any time. Even if you receive a new bill and need to update your information, you can easily make the necessary changes through the downloadable form. In addition, there is no need to print out documents whenever you need to make changes. With the downloadable form, there is no need for you to deal with difficult paper work such as re-orders and addressing. Lastly, some people choose the downloadable form of address format for their business so that they can take advantage of the ease of printing and mailing out bills and other forms of correspondence to clients.

Conclusion

If you are considering getting a new mailing address in Canada, you may want to consider downloading the online form. By using the online option, you can choose from a wide variety of styles and formats. In addition, if you have questions about the downloadable form or have problems creating it on your own, you can contact the support staff for Canadian mailing address format services. Support staff can help you download and set up the format to ensure that you are able to effectively communicate with your customers. They also can assist you with any other concerns or questions that you might have.

Overall, you will find that the advantages of mailing address format Canada make it easier for you to get your message out. You can get your new address onto the envelopes and have the information appear on your letterhead and labels in an effective and efficient manner. When you compare the costs of mailing address format Canada with the prices of regular paper mail, the money you save can be quite significant. Furthermore, when you consider that you can still look professional and deliver your messages in an organized fashion using the downloadable form, it makes it easier than ever to do business in Canada.

Postcard dimensions have everything to do with the way you can use the postcards. The postcard must fit perfectly into the envelopes, and if it doesn’t, the contents of the postcard will not be revealed. You cannot hide postcards inside envelopes, and that is why postcard dimensions are very important. For many years, postcards were almost always used in mailing houses as well as post office. But recently, as postcards became much more popular, there has been an increased use of these postcards for marketing purposes as well as for sending direct mail advertisements and catalogues, just as they were in the past.

Postcard dimensions vary according to what you want to send and how you wish to distribute them. If you are using postcard apps for mailing, you can use standard postcard dimensions that can fit any envelope. For sending through catalogues or via email, you need to make sure the dimensions fit the specifications.

The most commonly used postcard sizes

These are standard postcard dimensions used for mailing postcards, they must meet all the requirements by the postal service. For mailing, the size must be large enough to hold all the contents, it is a good idea to consider this aspect, as you don’t want to receive an entire postcard, only to find out it is too big for the envelope or too small for the contents. The 4 x 6 postcards are great for mailing brochures, manuals, or other large items that need to fit into a larger envelope. These also fit inside regular-sized envelopes just like mail envelopes.

Postcard dimensions must meet all the printing requirements. Every printing company does this, but some only deal with specific types of postcard sizes, and you must be careful to only deal with a printing house that can meet your postcard dimensions needs. Some of these requirements include a white ink postcard stock, which is easier to handle and more professional-looking than colored stock. Make sure the printing house you use will provide white paper for your postcard dimensions request.

You can request the standard postcard dimensions in different formats. If you send a postcard through the internet, it is best to upload the image and get the dimensions from the resource. If you are printing it through the post office, simply ask what sizes are available, and if there are any special requirements. It’s important that your postcard dimensions are correct, and post offices are used to custom orders so they should be able to accommodate your requests.

When choosing your postcard dimensions, make sure you choose one that is standard, so your mailing will fit into all post offices. You can get special orders made for mailing to certain areas or to specific carriers. Ask what options are available for your mailing size, and also what additional options are available for your mailing size. For instance, many businesses have their own carrier options, such as priority mail, express mail, and overnight shipping. You may want to see what choices are available to you when choosing your postcard mailing size, so you can determine if you need this option or not. Some Post Office’s offer bulk mail services, which allow you to choose a large postcard mailing size and get additional discounts on additional mailings.

Conclusion

The cost to ship your postcard depends on the shipping options you have chosen. If you choose air postage, it will cost much less than the standard postcard size. If you choose priority mail, it will cost even less than standard postcard dimensions. Many places have online ordering capabilities, which make the whole process easy. It is important to ask what options are available for these services, because there may be a limitation on how many you can purchase at a time. Most printing companies can create custom postcards for any size and style, but some only do standard postcard printing.

Your direct mail campaigns should be informative, not promotional. When you focus on offering information that is helpful to your customers and potential customers, your chances of creating a positive customer experience are much higher. By taking the extra time to work with your printers and computer experts to create personalized postcards, you will help make sure your campaign reaches its goal.

There are many obvious reasons to hire a digital marketing agency in Toronto. However, the reasons vary as per the nature of your business. Digital marketing company Toronto has become one of the famous names in the market. The marketing agencies are mostly required before you take a huge leap in your business. The marketing agencies help to advertise your products and you should be able to see significant growth in a short span. All the reasons are elaborated below.

For business growth

The digital marketing agencies work with great efforts to make your business grow in no time. They want to gain trust and without showing a result that isn’t possible. Hence work day in and out to ensure that your business gets the best results in terms of profit, good will, and popularity. You can expect high growth rates when you bestow your trust in a digital marketing company. They develop strategies that help in business growth.

You can spare time to focus on your company

One of the best reasons for hiring a digital marketing firm is that you don’t have to worry about your marketing strategies for your business. It takes time to get the right marketing approach and it would best be done by the experts. When a dedicated team of the marketing agencies works on it, you can expect flawless results without your involvement. When you don’t have to engage in marketing matters, you can solely concentrate on your business.

Save money

You save a lot of money when you work with an agency instead of hiring an in-house team. The personnel from the agency would come and work for a certain period. They would charge a one-time fee. However, it would be expensive if you have to hire employees. Additionally, you also don’t have to bother for payroll and payroll taxes. The agencies provide value-added services without you having to spend thousands of dollars.

Working with a specialist has its benefits

The marketing agencies have many years of experience and have diverse knowledge as they have worked with many organizations. This enables them to come up with effective strategies and unique ideas to resolve your marketing issues. You can rely upon them without a hint of doubt. They are sure to take care of the company’s needs. Also, you don’t have to learn marketing strategies for your business. It’s their work and they would do it with their proficiency.

Efficient marketing tools are beneficial

There is no doubt that the marketing agencies have more marketing tools that make up for a good reason to hire them. The big and famous agencies spend thousands of dollars to upgrade their software and programs which they use. They have taken subscriptions to many programs that give the main insight of how your ads are performing. The professionals of the agencies know how to use the tools extensively. When you hire the agencies you can use the program without buying or leaning them.

Before getting in touch with any of the digital marketing agencies, think about it twice whether you need to spend your hard-earned money on some external marketing help. If you get any of the options mentioned above as an answer, then go ahead and hire the best one.

Buying jewelry is not as easy as people can scam you. There are different types of jewelry scams are happening now around the world. So, what you need is to act as an expert. Never act like a novice while you are going to buy jewelry so that the salesperson never gets the chance to dominate you. If you show that you are nervous, the salesperson will get the chance to dupe you. Today, you will get certain tips to buy jewelry like professional Toronto jewellers. Read on to know more-

-

Color Stones Are Treated

You need to know that there are no natural-colored gemstones in any jewelry stores and if you are buying any stone-fitted jewelry, you will get all treated color stones. If the salesperson says that the gemstones are naturally colored, he is lying to you. If you are buying natural pearls, then you should also be aware of the quality as the natural pearls are quite rare. There are lots of reputed jewelry houses that sell cultured pearls as natural pearls but beware of them.

-

Always Suspect the Stone of a Set

Many of you love stone-fitted jewelry where small stones are fitted on a set of jewelry. While buying such a thing, you should ask the salesperson to clean the piece of jewelry well and then inspect it with your naked eye. Once you are done, you can ask for a loupe, a very small magnifying glass to inspect the piece of jewelry and the stones minutely. If the jeweler doesn’t allow you to do it, you have to think twice whether you buy from him of not.

-

Hallmark Can Be Fake

If you think the stamp of Pt in platinum or 18k in gold jewelry is the ultimate criteria to have original metal, you are wrong. These stamps can be faked! How do you make a difference between white gold and platinum if you find an 18k stamp in both of them? White gold is shinier with a yellow tone and it will also be lighter than platinum. You can ask the owner of the jewelry shop about the history of the piece and its authenticity. You should also tell them that you will justify the authentication from an individual expert.

-

You Should Not Buy at Your First Visit

At the first visit, you can go to the shop, check out the designs, take the card and leave without sharing any of your information. You need to do certain homework before buying and tally the price of the piece online. Also, you should bargain for the piece you are interested in before buying. You can also say that you are getting a better deal at some other shop.

-

Jewelry Is Not an Investment

This is the advice that you will receive from the salesperson that jewelry is an investment. If you also get it, ask him to sign a paper by stating that he will buy it from you at a 5 percent increase in the price after a year. No jewelry shop will admit it and if so, it is not an investment.

Thus, you can be a pro like a jeweler while buying any piece of jewelry. Never see a diamond in the sunlight, don’t believe in certifications until you check it from the issuing agency, and also trust your intuition while buying jewelry.

Area master Michael Ballenger is viewing the gold market and counts on circumstances in silver. You can now easily buy silver Canada.

“The longing for gold is the most all-inclusive and profoundly established business intuition of humankind.”— Gerald m. Loeb

Perhaps the best book at any point composed on contributing was “the fight for venture survival,” by Gerald m. Loeb, the supplier of the present statement and a genuine legend in the inaccessible, long-overlooked universe of free-market private enterprise. Additionally credited with “put all of your investments tied up on one place and watch the container,” it was an undeniable affront to the individuals who eat, drink and inhale the broadening mantra.

Having kept away from the fiasco in the 1929 market crash, Loeb was profoundly influenced by the staggering swath it slice through the monetary field of vision and was one of the first other of his period to expose the “long haul contributing” track record, picking rather exchange positions as opposed to holding. I read the book in 1974 and wondered about how, thirty-nine years after its underlying distributing run, despite everything it held importance, a quality that numerous expert speculators need to give the quickly changed/changing universe of budgetary items accessible to ages of new financial specialists around the world. Every now and then, I will bring it down from the bookshelf in my investigation, set out a glass (or two) of fine wine and peruse the numerous parts looking for old, revered exercises and decides that I regard still completely applicable here in the time of our master 2019.

The way that gold remains “the most all-inclusive and profoundly established business intuition of humankind” characterizes the motivation behind why the paper vendors (financiers, dealers) disdain its very presence. Since 1977, when I joined the Canadian protections industry, I have viewed with contemptible awfulness the coordinated crusade of deception, disinformation, publicity, and misrepresentation overlooked, advanced and executed by the “destroyers” (as ayn rand called them) as a methods for influencing the “want” referenced by Loeb from gold to”financial resources” (counting stocks and bonds). Budgetary news systems, not to be found anyplace until the 1980s, served to idolize stock proprietorship, and the evidence of that is the ascent in family unit responsibility for from 4% in 1974 to over half continuously 2000.

In light of the power of the message being communicated by the elitist brokers and lawmakers, gold has been an undesirable house visitor, only every once in a long while to be welcome to any of the festivals, for example, the “record-breaking highs!” or “dow 30,000” parties so normal in this time of crazy cash corruption working under the false name of “income sans work.” today, there is a generational propensity that permits the “most all-inclusive and profoundly established business sense of mankind” to be the craving for paper riches through stocks, a characteristic held by over 65% of all twenty to thirty year olds, who is an ongoing study said that they favored pc produced “purchase” suggestions as opposed to those by exceptionally taught, splendidly prepared carbon units.

The reason I compose this note is that being a gold or silver “master” gives a capacity to an undeniably contracting business sector, in the equivalent tragic way wherein surrey whip makers were constrained from importance by the innovation of the car. Being splendidly prepared by splendid coaches in the significance of tying down one’s riches in strong, reliable stores of significant worth, for example, gold and silver conveys next to zero convenience in a world oversaw, controlled and shaped by the paper traders, as a long time upon year the concealment of valuable metals walks on.

In any case, in June 2019, there was an occasion that broke the shackles of value the executives for gold with the close otherworldly flood to $1,442/ounce, at last emptying a six-year band of opposition notwithstanding overwhelming shorting by the plugs and a truly failing to meet expectations silver market, so buy silver Canada. With the hui now over 200 just because since January 2018, it needs to get over 225 to set up the strike on 280, the August 2016 high. Of real centrality to the physical metals is this: the excavators must lead the charge to the 2016 highs, accepting the position of authority and the gold-to-silver proportion (GSTR) must be in full drop as it occurs.